31+ Time to pay off debt calculator

Examples of How Long It Will Take to Pay Off 10000 in Debt. Debt Payoff vs Savings Summary.

Img004 Jpg

Make biweekly payments toward debt.

. Ad For US Residents Get Payoff Relief for 15000-150K Bills Without Bankruptcy or Loan. Enter the current monthly. The calculator uses this to calculate how long it will take to pay off your debts and how much you will pay in interest.

Your monthly payment for 10 years would be 212 and you would pay 5440 in interest. With our Student Loan Debt Payoff Calculator you can check how long it will take you to pay off your student loans based on your current loan details. See If You Qualify.

Ad Learn more about REPAY and how we can be a one-stop shop for your payments. Your desired payoff time-frame is the amount of time you would like to pay. How to use our debt payoff calculator 1.

Our calculator can help you estimate when youll pay off your credit card debt or other debt such as auto loans student loans or personal loans and how much youll need to pay each. Enter the current balance owed on the debt if you were to pay off the debt today. One time Biweekly repayment Normal repayment Payoff in 14 years and 4 months The remaining term of the loan is 24 years and 4 months.

Enter loan information For this step youll need to input the basic information you collected about your existing debt into the debt calculator including. You can see the impact of a lower rate. Input some information about your current credit card and loan debts including how much you owe interest rate and.

What if you paid 100 a month more toward that loan. By using your 50 per month to pay off debt rather than save you will save 11684 in interest charges and pay off your debt in 23 month s rather than your. Understand What You Can Change to Meet Your Credit Card Repayment Goals.

Enter the annual interest rate being charged by the lender. How to use our loan payoff calculator. Alternatively you may pay off your debt by making payments every two.

Ad Use The Credit Card Pay Off Calculator To Set Your Goals for Paying Off Your Balance. And as you define your strategy for eliminating credit card debt you can enter different payment amounts to see how much. Your monthly payment would.

By paying extra 50000 per month the loan will be. Use this calculator to determine how much longer you will need to make these regular payments in order to eventually eliminate the debt obligation and pay off your loan. Enter your loan details.

Add the result to each monthly installment by dividing your payment by 12. If you are curious how long it will take you to pay off debts use this debt payoff calculator to get an accurate idea of the total interest charges number of monthly. Start Easy Request Online.

REPAY has industry-leading payment security including PCI DSS compliance. Join 9 Million Residents Already Served. Remember you can add multiple credit cards to the calculator.

How To Pay Off Debt Fast Myhomeanswers

2

31 Free Personal Finance Homeschool Resources

How To Pay Off Debt Fast Myhomeanswers

Pin On Family Fun Food Frugality Group Board

Free 31 Sample Daily Log Templates In Pdf Ms Word With Regard To Pool Maintenance Log Template Ms Word Pool Maintenance Templates

Federal Student Loans Piedmont Virginia Community College

G201504061231515332622 Jpg

Technical Support Report Template 8 Professional Templates Business Plan Template Free Business Plan How To Plan

![]()

How To Save Money Fast 3 Tricks Above 1000 Hr

A Thoughtful Non Toy Gift Guide 31 Gift Ideas For Children That Non Toy Gifts Toys Gift Eco Friendly Holiday

Pin On Savings Side Gigs Financial Success

31 Inspirational Quotes For First Year Teachers Great Teacher Quote Quotes Teachi Teacher Quotes Inspirational Education Quotes Education Quotes For Teachers

Img008 Jpg

Home Budget Template Basic Budget Template How To Make Basic Budget Template For Personal Ne Home Budget Template Budget Template Household Budget Template

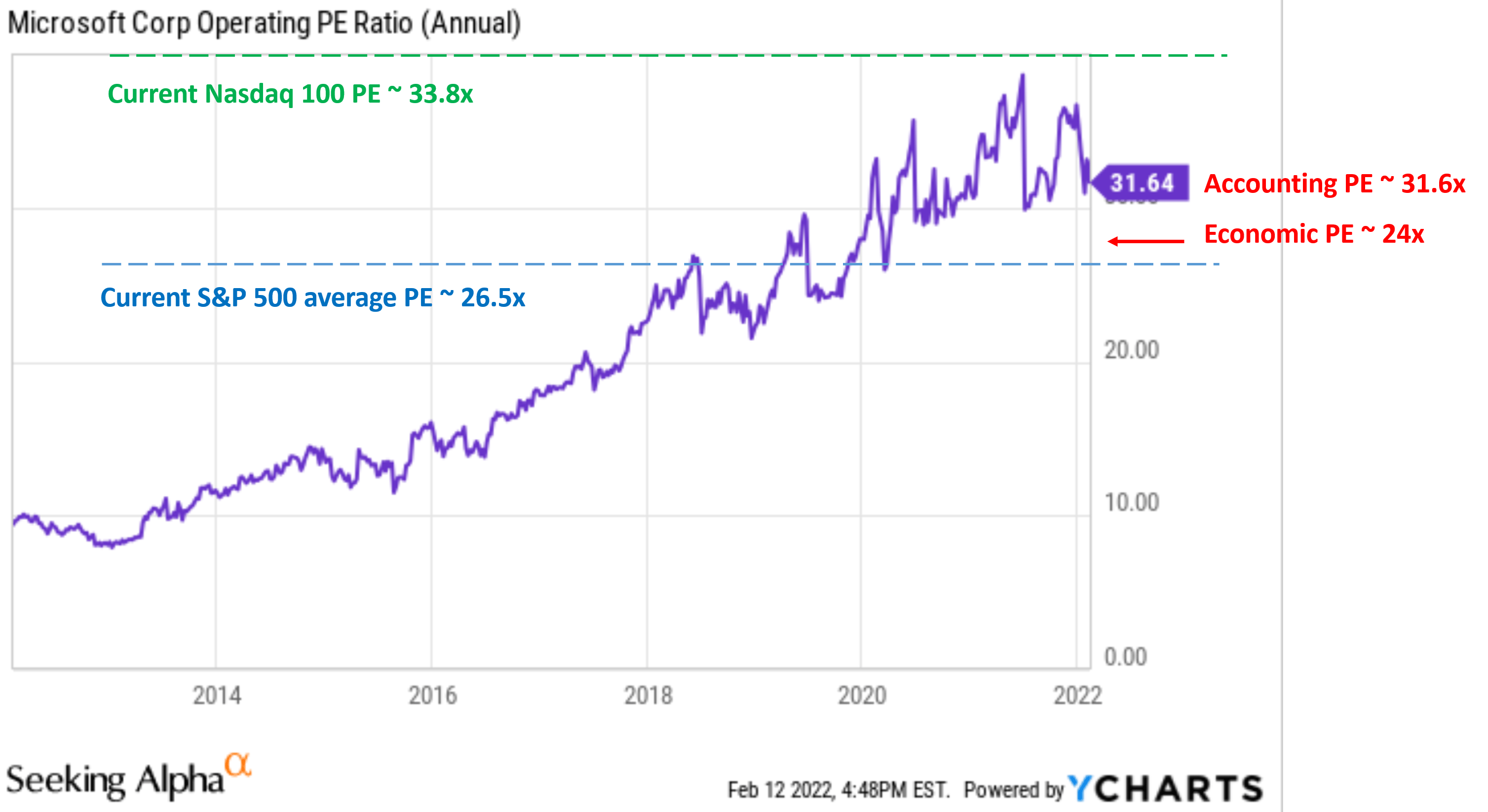

Microsoft S Actual P E And Why It Is Only About 24x Msft Seeking Alpha

2